Purchasing your first property represents one of life’s most significant financial decisions. The excitement of ownership mingles with anxiety about making the right choice. This comprehensive guide helps you navigate the process with clarity and confidence.

Define Your Genuine Requirements

Before falling in love with properties, establish what you actually need versus what looks appealing on social media. Your first purchase should serve your real life, not someone else’s lifestyle.

Ask yourself: Can you manage a longer commute for more space, or does proximity to work matter more? If you’re based in Whitefield’s tech corridor, a strategically located 2 BHK might deliver better quality of life than a distant 3 BHK requiring daily two-hour commutes.

Consider your three-to-five-year trajectory. Family planning, career moves, and aging parent care all influence whether a compact unit or larger configuration makes sense. Be honest about whether that extra bedroom serves a purpose or simply strains your budget.

Why Location Deserves Your Attention

Real estate professionals universally agree: location is the only unchangeable element. Renovations can transform interiors, but your building stays put.

Evaluate essentials like hospital accessibility within 20 minutes, quality educational institutions if children factor into your plans, and the area’s development stage. Has infrastructure already matured, or are you betting on future growth?

East Bangalore localities demonstrate dramatic transformation. Whitefield, Hoskote, and Kadugodi have evolved from emerging areas to established neighborhoods, driven by the Peripheral Ring Road, enhanced metro connectivity, and IT industry concentration.

Micro-location within these areas matters equally. Nallurahalli exemplifies smart positioning—offering Whitefield’s infrastructure advantages without central area chaos. For first-time buyers, established infrastructure trumps speculative future development.

Complete Financial Picture

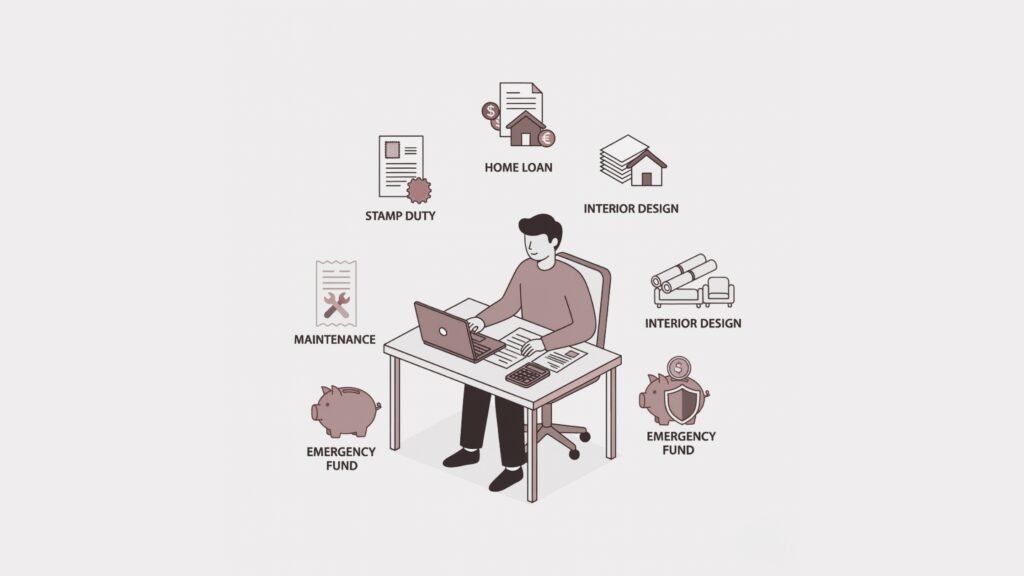

The sticker price tells only part of the story. Your actual investment includes multiple components many buyers overlook.

Karnataka’s stamp duty and registration fees add roughly 7-8% to property costs. Include home loan processing charges, insurance premiums, interior fit-out expenses, maintenance deposits, and six months of emergency reserves for unexpected repairs.

Financial planners advise keeping EMI commitments below 40% of monthly income. Exceeding this creates financial stress that undermines homeownership satisfaction.

Configuration choices significantly impact affordability. If a 3 BHK pushes beyond comfortable limits while a 2 BHK feels insufficient, explore 2.5 BHK options—providing a two-bedroom setup with an additional smaller room suitable for home offices or nurseries. This middle ground, though not universally available, offers valuable flexibility for budget-conscious first-time buyers.

Home Loan Strategy

Securing loan approval differs from obtaining favorable terms. Interest rate differences of even 0.25% accumulate to lakhs over 20-year repayment periods.

Maintain credit scores above 750 for optimal rate negotiations. Obtain pre-approval to understand realistic budget parameters before property hunting. Despite the effort involved, compare at least three lenders—the savings over two decades justify the initial work.

Understanding fixed versus floating rates, processing fees (potentially 1% of loan amount), and how builder reputation affects approval speed empowers better decisions.

Properties in established projects with solid builder credentials and complete RERA compliance typically secure faster approvals and better rates, as financial institutions perceive reduced risk.

Navigating loan documentation, eligibility calculations, and lender comparisons benefits from expert support. Professional guidance through Diligent Consulting helps decode financing complexities, ensuring you secure terms matching your financial situation while avoiding common pitfalls.

Construction Stage Considerations

Choosing between under-construction and ready-to-move properties depends on personal circumstances rather than universal rules.

Under-construction suits buyers with 2-3 year timelines who can continue renting comfortably. Cost savings of 10-20% reward patience and flexibility with possession dates.

Ready-to-move properties cost more but deliver immediate certainty. You inspect the actual product and transition without delay. If current rent is substantial—for instance, ₹25,000 monthly in Whitefield—channeling that toward EMI payments makes ready-to-move properties financially logical despite higher upfront costs.

RERA's Protective Role

The Real Estate Regulatory Authority provides crucial buyer protections. RERA prevents builders from advertising nonexistent amenities, ensures 70% of collected funds finance actual construction, and creates clear dispute resolution pathways.

Verify RERA registration before any payment. This five-minute check potentially saves years of complications. Reputable developers readily provide RERA details; reluctance indicates problems.

Bedroom Configuration Logic

The 2 BHK versus 3 BHK decision troubles many first-time buyers. Apply systematic thinking:

Two-bedroom units work when you’re single or a couple without immediate family plans, need home office space, prefer lower monthly outflows, or prioritize reduced maintenance expenses.

Three-bedroom configurations suit those with children or concrete family expansion plans, who regularly accommodate extended family visits, require separate work-from-home and guest spaces, or plan staying 10+ years without upgrading.

For couples planning families within a few years but facing 3 BHK budget strain, 2.5 BHK configurations provide practical middle ground—offering growth capacity without full 3 BHK financial commitment.

Effective Property Inspections

Site visits should investigate functionality, not admire model apartment décor. Your checklist should include:

Test water pressure by running all taps simultaneously. Verify mobile network quality with actual calls. Check natural lighting and ventilation during daylight hours. Assess sound insulation between units if possible. Confirm real views versus brochure photography. Evaluate common area maintenance quality.

In ready properties, speak with current residents. They provide honest insights about water supply consistency, power backup reliability, and management responsiveness that sales representatives won’t volunteer.

Unmistakable Warning Signs

Certain red flags demand immediate exit regardless of attractive pricing: unclear RERA status, vague possession commitments, unrealistic pricing, aggressive sales pressure, no completed project portfolio, land title disputes, or construction site access restrictions.

Trust your judgment. Quality real estate advisors welcome scrutiny rather than discouraging questions.

Timing Your Purchase

Perfect market timing doesn’t exist. Interest rates fluctuate, prices move, economic conditions change. Focus instead on personal readiness:

Buy when you have stable employment and consistent income, have accumulated 20-25% of property value, plan staying locally 5-7 years minimum, have found a property satisfying most requirements (perfection is impossible), and monthly EMI plus maintenance feels sustainable rather than suffocating.

Your first property need not be your final property. It should be a strategic step that appreciates reasonably, meets immediate needs, and maintains financial comfort.

Value of Expert Guidance

Real estate markets challenge first-time buyers with complexity, jargon, and conflicting interests. End-to-end consulting—covering property identification, loan assistance, documentation review, and post-possession interior planning—transforms the experience.

Quality consultants ask uncomfortable but necessary questions about true affordability and resale prospects rather than merely pushing high-commission properties.

Ultimately, buying your first home feels overwhelming. Second-guessing yourself is normal. The key lies in thorough homework, asking difficult questions, and partnering with professionals who genuinely listen to your needs rather than imposing sales agendas.

Whether exploring established areas like Whitefield or emerging East Bangalore localities, whether needing a compact 2 BHK or spacious 3 BHK, the right property exists. It may not check every wish list item, but it will satisfy what truly matters for your life.

When you finally hold those keys and step into your first owned space, all the stress and paperwork will make sense. Your first home is out there—go find it with confidence.